DO YOU FEEL THAT YOU WERE UNDERPAID ON YOUR HURRICANE CLAIM????

I MAY BE ABLE TO GET YOU ADDITIONAL

MONEY IN AS LITTLE AS 90 DAYS!

ACT FAST FOR YOUR

FREE HURRICANE

CLAIM REVIEW

find out if you were underpaid

At Loss Recovery Experts, we protect Florida homeowners and commercial property owners to ensure they receive the full compensation they deserve for their residential or commercial property claims.

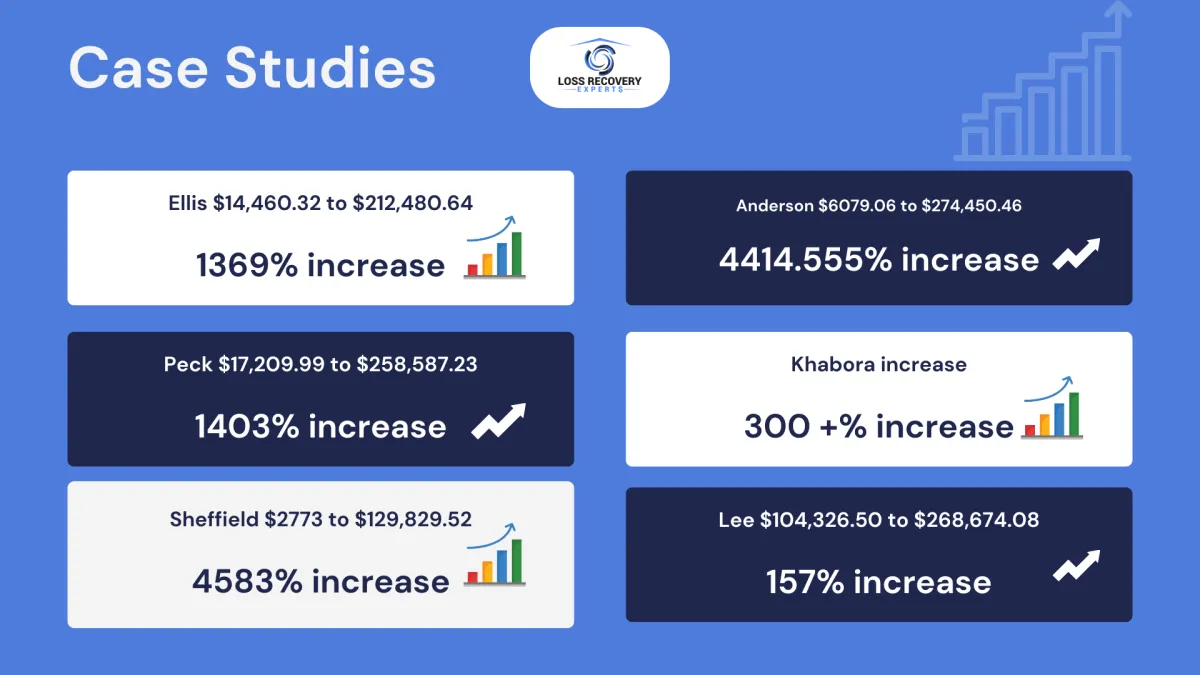

Insurance companies are looking out for their bottom dollar. We look out for our client’s best interests - not the insurance company. Our results speak for themselves.

we fight for you

While insurance companies focus on protecting their profits, we focus on protecting you.

Find out if you were underpaid!

Collect what you are rightfully owed.

If your insurance company owed you a new roof, windows or interior damages would you want to collect?

Call Today! 833-987-4646

WE ARE THE BEST choice FOR YOU

Why Choose Loss Recovery Experts?

Loss Recovery Experts is the premier loss recovery expert in Florida and we specialize in preventing costly insurance mistakes, ensuring your damage claim, whether residential or commercial, receives proper compensation.

Beware, your insurance company may aim to minimize payouts.

As the best damage appraisers in Florida, we advocate against insurance companies to secure full and proper compensation for your damages. Trust us to navigate the complexities and fight for your rights, making your property whole again.

Feeling Frustrated that you were Underpaid? An Insurance Appraisal Can Help.

If you’re a homeowner or business owner struggling with an unfair insurance settlement, you’re not alone. When the settlement offer doesn’t cover the real cost of your damages, it’s more than frustrating – it’s overwhelming and unfair. Too often, insurance companies put profits over policyholders, leaving you with a payout that falls short.

The Solution? Insurance Appraisal

To be clear, an Insurance Appraisal is NOT a home appraisal. An Insurance Appraisal is a method within many insurance policies that allows policyholders to resolve disputes over claim values without the long, costly process of a lawsuit. In an insurance appraisal, you and your insurance company each select a professional, independent appraiser to assess the value of the damages. If they can’t reach an agreement, a neutral umpire steps in to make the final call, ensuring fairness for both sides.

How Does an Insurance Appraisal Work?

The Insurance Appraisal Process: Simplified

1. Start the Appraisal: If you disagree with the settlement offer, you can initiate the appraisal process. How? See #2

2. Choose an Expert: You hire Loss Recovery Experts to represent you for a fair and equitable settlement. We work for you and not the insurance company.

3. Evaluate and Negotiate: We independently assess the damage and negotiate a fair claim.

4. Involve an Umpire (if necessary): If the appraisers disagree, an impartial umpire makes the final decision.

5. Get a Fair Settlement: Once an agreement is reached, the decision is binding, so you can move forward with confidence.

Don’t Let an Unfair Offer Be the Final Word

If you’re unsure, don’t worry; we’re here to help. At Loss Recovery Experts, we’re experienced in guiding homeowners and business owners through the Insurance Appraisal process, ensuring they receive the fair settlement they deserve.

Getting an Insurance Appraisal is your right and can relieve the stress and confusion of underpaid claims. Many homeowners and business owners don’t know about this option, but Loss Recovery Experts is here to guide you every step of the way. We have your back.

Call Loss Recovery Experts now, and let’s fight for the settlement you deserve.

We don't get paid if you don't get paid.

Coverage Areas *ALL OF FLORIDA*

It only takes 5 minutes to get on a call

Call Today! 833-987-4646

We don't get paid unless you get paid.

Office: 3823 Tamiami Trail E Unit 213 Naples, FL 34112

Call : 833-987-4646